In the landscape of life insurance, term life insurance stands out as a flexible and affordable option for individuals seeking to protect their loved ones against the financial burdens of unexpected events. Unlike permanent life insurance policies, which provide coverage for the insured’s entire lifetime, term life insurance offers protection for a specified period, known as the term of the policy. In this comprehensive guide, we’ll explore the ins and outs of term life insurance, including its features, benefits, considerations, and why it’s a valuable tool for financial planning.

Understanding Term Life Insurance:

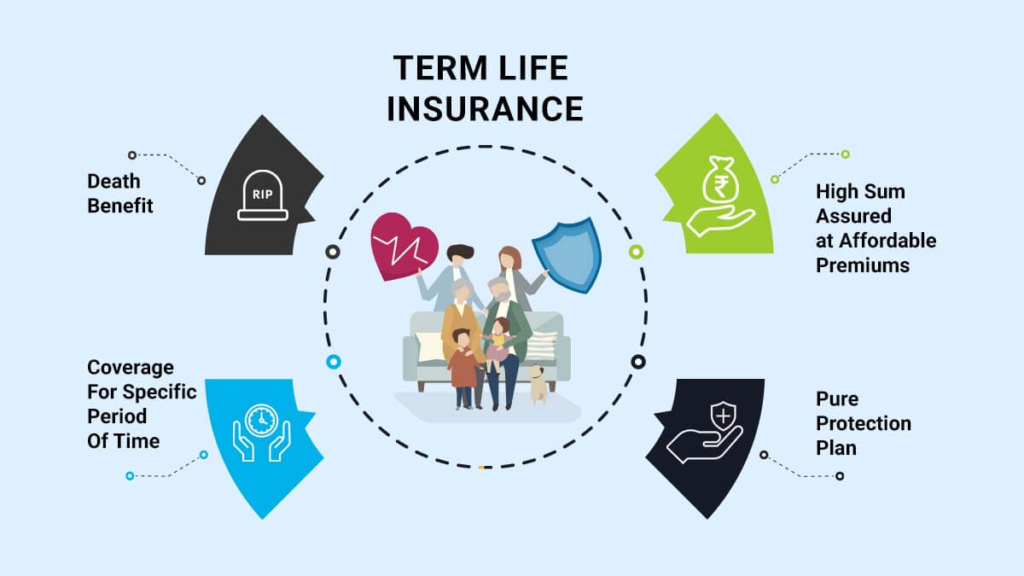

Term life insurance is a type of life insurance policy that provides coverage for a predetermined period, typically ranging from 10 to 30 years. During the term of the policy, if the insured passes away, the insurance company pays a death benefit to the designated beneficiaries. Term life insurance is known for its simplicity and affordability, making it an attractive option for individuals and families seeking to protect against specific financial obligations or provide temporary income replacement in the event of premature death.

Key Features of Term Life Insurance:

- Fixed Premiums: Term life insurance policies typically offer fixed premiums for the duration of the term, providing predictability and stability in premium payments. This allows policyholders to budget effectively and avoid fluctuations in insurance costs over time.

- Temporary Coverage: Unlike permanent life insurance policies, which provide coverage for the insured’s entire lifetime, term life insurance offers temporary coverage for a specified period. Policyholders can choose the term length based on their financial goals, such as covering mortgage payments, funding children’s education, or providing income replacement until retirement.

- Death Benefit: In the event of the insured’s death during the term of the policy, term life insurance pays a death benefit to the designated beneficiaries. The death benefit is typically a tax-free lump sum payment that can be used to cover living expenses, pay off debts, fund education expenses, or provide financial security for loved ones.

- Convertible Options: Some term life insurance policies offer convertible options, allowing policyholders to convert their term coverage into permanent life insurance policies without undergoing a medical exam or providing proof of insurability. This flexibility allows policyholders to adapt their coverage to changing financial needs and circumstances over time.

Benefits of Term Life Insurance:

Term life insurance offers numerous benefits for individuals and families:

- Affordability: One of the primary benefits of term life insurance is its affordability relative to other types of life insurance, such as whole life or universal life insurance. Term life insurance premiums are typically lower, making it accessible to individuals with varying budgetary constraints.

- Flexibility: Term life insurance offers flexibility in terms of coverage length, allowing policyholders to choose the term that best aligns with their financial goals and obligations. Whether you need coverage for 10 years, 20 years, or 30 years, term life insurance allows you to tailor your coverage to your specific needs and circumstances.

- Income Replacement: Term life insurance provides an essential source of income replacement in the event of the insured’s premature death. The death benefit can help replace lost income, cover living expenses, and maintain the family’s standard of living, ensuring that loved ones are financially provided for during a challenging time.

- Debt Protection: Term life insurance can be used to protect against outstanding debts, such as mortgages, car loans, credit card debt, and student loans. In the event of the insured’s death, the death benefit can be used to pay off these debts, preventing financial hardship for surviving family members and ensuring that assets are preserved.

- Estate Planning: Term life insurance plays a crucial role in estate planning by providing liquidity to cover estate taxes, settlement costs, and other expenses associated with transferring assets to heirs. It allows policyholders to pass on their wealth to future generations without burdening beneficiaries with tax liabilities or the need to liquidate assets.

Considerations for Term Life Insurance:

While term life insurance offers many benefits, there are some considerations to keep in mind:

- Temporary Coverage: Term life insurance provides coverage for a specified period, after which the policy expires. If the insured outlives the term of the policy, coverage ends, and no death benefit is paid. Policyholders should carefully consider their coverage needs and select a term length that aligns with their financial goals and obligations.

- No Cash Value: Unlike permanent life insurance policies, which accumulate cash value over time, term life insurance policies do not build cash value. Policyholders pay premiums solely for the death benefit, and there is no savings or investment component associated with term life insurance.

- Health Considerations: The cost of term life insurance premiums is influenced by factors such as age, health, lifestyle, and coverage amount. Policyholders may be required to undergo a medical exam and provide information about their health history to determine eligibility and premium rates.

- Coverage Limits: Term life insurance policies have coverage limits, which represent the maximum amount of the death benefit payable to beneficiaries. Policyholders should carefully evaluate their coverage needs and select a death benefit amount that provides adequate financial protection for their loved ones.

Term life insurance is a valuable tool for individuals and families seeking to protect their loved ones against the financial consequences of premature death. With its affordability, flexibility, and essential coverage benefits, term life insurance offers peace of mind knowing that loved ones are financially provided for in the event of the insured’s passing.